Robinhood’s Stock Surge with New Card

Robinhood Gold Card: A New Era of Cash Back Rewards

Robinhood’s Strategic Move into Credit Cards

In a move that has sent shockwaves through the financial technology sector, Robinhood has officially launched its Gold Card, a credit card that promises to revolutionize the way users earn cash back on purchases. The Gold Card marks Robinhood’s entry into the competitive credit card market, following its acquisition of X1, a startup known for its innovative approach to credit card rewards.

Unprecedented Cash Back Rewards

The Robinhood Gold Card is poised to offer an unprecedented 3% cash back on all stock purchases, a feature that is expected to resonate with the platform’s user base of active investors. This reward structure is a departure from the industry standard and is designed to incentivize more transactions within the Robinhood ecosystem.

Innovative Cash Back Utilization

One of the standout features of the Gold Card is the ability for users to utilize their cash back earnings to invest in stocks, a testament to Robinhood’s commitment to integrating its financial services. This feature, inherited from the X1 acquisition, allows users to reinvest their rewards, potentially amplifying their returns over time.

A Sustainable Business Model

While the 3% cash back offer is attractive, it raises questions about Robinhood’s business sustainability. The company will need to carefully manage the financial implications of such a generous reward structure to ensure long-term profitability and user satisfaction.

Competitive Advantage and User Experience

The launch of the Gold Card is part of Robinhood’s broader strategy to offer a comprehensive suite of financial services. By providing a seamless user experience and competitive rewards, Robinhood aims to attract and retain a loyal customer base, while also challenging established players in the credit card industry.

Looking to the Future

As Robinhood continues to innovate and expand its offerings, the Gold Card represents a significant step forward in its mission to become a one-stop shop for financial services. The success of the Gold Card will be closely watched by industry observers and competitors alike, as Robinhood looks to redefine the boundaries of digital finance.

Impact of Robinhood Gold Card on Robinhood’s Stock Value and Investor Relations

Analysis of the Gold Card’s Influence

The launch of the Robinhood Gold Card represents a strategic move by Robinhood to diversify its revenue streams and enhance user engagement. The unique cash back rewards structure, particularly the 3% cash back on stock purchases, is expected to drive increased transaction volume and user loyalty. This could potentially lead to higher revenue and a stronger financial position for Robinhood, which could positively impact its stock value.

Investor relations are likely to benefit from the Gold Card’s innovative features, as it aligns with Robinhood’s mission to provide a comprehensive suite of financial services. The ability for users to reinvest their cash back earnings into stocks could lead to a virtuous cycle of increased engagement and retention, which is a key metric for investors. However, the sustainability of the 3% cash back reward and its impact on Robinhood’s profitability will be closely scrutinized by the investment community.

Investor Sentiment and Market Reaction

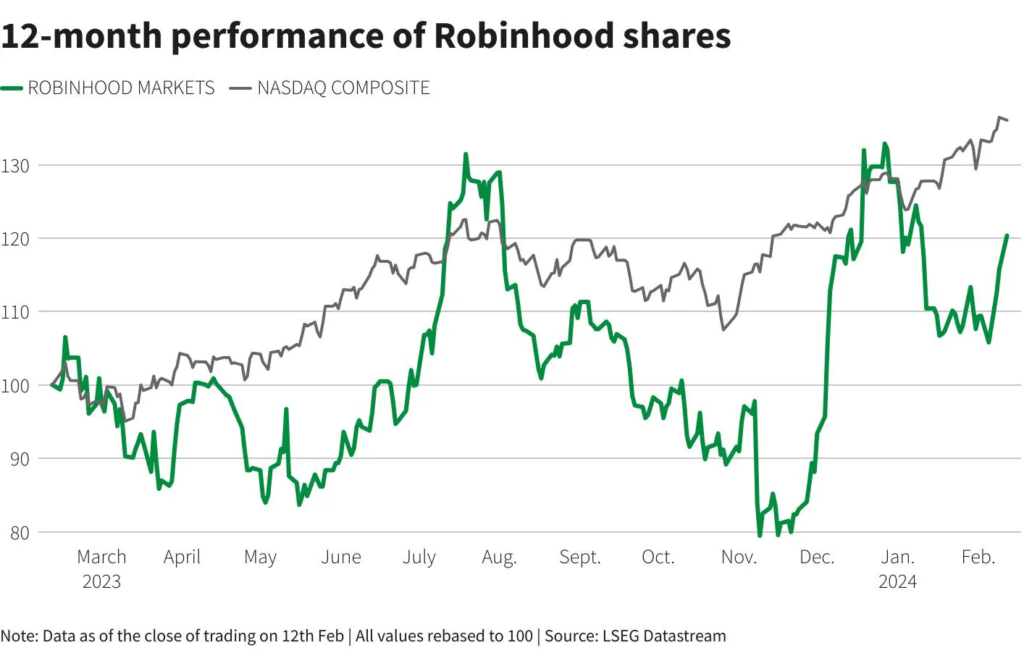

The market’s reaction to the Gold Card launch will be influenced by investor sentiment towards Robinhood’s ability to execute its growth strategy. Positive sentiment could lead to an increase in the stock’s price, as investors anticipate higher revenue and profitability. Conversely, any concerns about the sustainability of the 3% cash back reward or Robinhood’s profitability could dampen investor sentiment and put downward pressure on the stock price.

Long-Term Growth Projections

The Gold Card’s impact on Robinhood’s stock value will be a long-term play, as the benefits of the rewards program are realized over time. The success of the Gold Card will depend on its ability to attract and retain users, as well as its contribution to Robinhood’s overall financial performance. As such, any projections of stock value increases should take into account the gradual nature of these effects. – USNEWSNBUZZ

Must Read Blogs:

- How Did Julie Andrews Lose Her Voice?

- Understanding the Potential Ban on TikTok: Insights Post House Advancements in the Aid Package

- Grammy Winner Star Mandisa dead at 47: A Legacy That Lives On

- Florida Communism Bill (House Bill 1557): Discussion and Controversy

- Former Florida governor and US senator Bob Graham passed away at 87.